THE LONG HAUL: How Do Freelance Musicians Buy Houses?

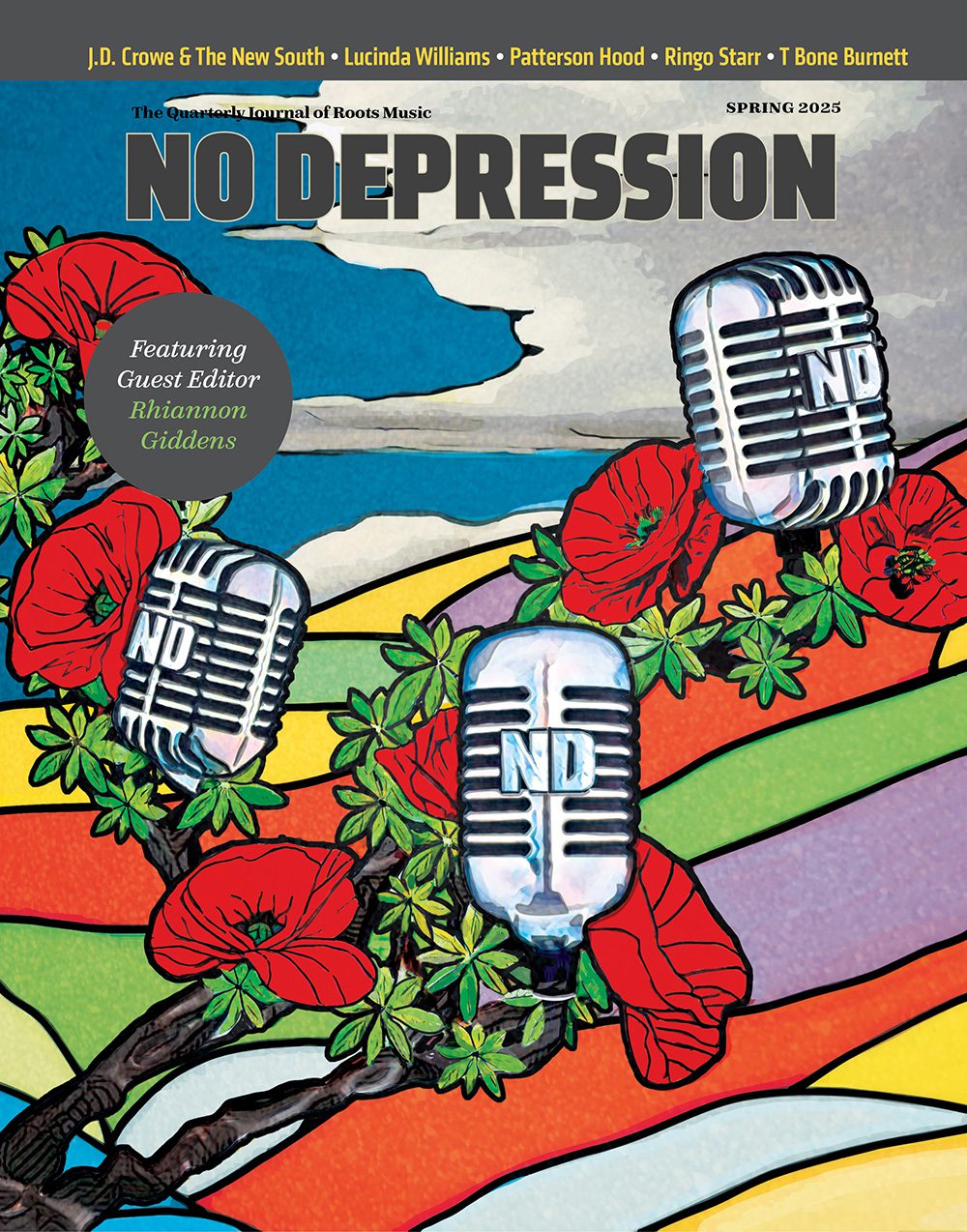

Christian Sedelmyer (photo by Natia Cinco)

EDITOR’S NOTE: This is the second of a three-part series in this column exploring financial challenges that affect musicians and their careers. Read Part 1, about how musicians are affected by student debt, here.

In 2013, the Joint Center for Housing Studies at Harvard University published a study on how homeownership affects wealth accumulation. The conclusion was unsurprising: Buying a home is one of the few ways that low-income people can build wealth and achieve financial stability and social mobility. For freelancers, including musicians, homeownership is especially important as we rarely have employer-matched retirement accounts or other areas in which to build long-term savings for our future.

The Harvard study, written by Christopher E. Herbert, Daniel T. McCue, and Rocio Sanchez-Moyano, concluded that “homeownership continues to represent an important opportunity for individuals and families of limited means to accumulate wealth. As such, policies to support homeownership can be justified as a means of alleviating wealth disparities by extending this opportunity to those who are in a position to succeed as owners under the right conditions.”

Like many other musicians and freelancers, I spent most of my 20s assuming that purchasing a home was entirely out of reach for me. Saving up a down payment seemed impossible since I was reinvesting every penny I made into my career, and even if I had a down payment, my income was so low that I didn’t see how I could qualify for a mortgage.

Well, it turned out that I was correct, purchasing a home was entirely out of reach for me. The thing that ultimately made it possible? Privilege: access to a co-signer (my father), who has a decent income as an adjunct professor at a small university and was willing to sign his name on my loan papers. Since owning a home, my entire financial outlook has changed. I no longer feel that it’s impossible to save money, or that I’ll be a pauper my whole life. I have done tons of renovations myself, which have added immense value to the property and improved my quality of life substantially. Homeownership does give a feeling of stability, despite its many stresses and unpredictable moments.

For people who have a salary, the process of proving income to a lender is relatively straightforward. You show your tax returns and pay stubs and that’s that. For freelancers, it’s much more complicated. Every freelance musician is essentially a small business, and at least in my experience, your life is also your career. Every trip you take in your car to a rehearsal or gig, every dollar spent to see your friend’s show, all of the gear and strings that you buy for your instruments, every hugely expensive recording project is an investment into your small business. As a result, you often end up with a very low or even a net loss of income when it comes to your taxes, like most fledgling companies in their first years.

Lenders will average the last two years of tax returns when they look at a freelancer’s income, so the obvious solution is to prepare to purchase a home by not writing off any expenses, therefore showing all of your income and none of your expenses and thus a kind of “inflated” income. I considered doing this for my own home purchase, but quickly realized that I would not only be slammed with very high tax bills (moving me further from my down payment savings goals), but additionally I would be disqualified from my subsidized health care through the Affordable Care Act, since that program also uses tax returns to determine eligibility. In that scenario I would suddenly have to pay up to $400 a month for health insurance (half the cost of the monthly mortgage I was trying to qualify for!).

As someone who has never once been late on a rent or utility payment, the system seems ridiculous. My credit score was and still is extremely high, and I was trying to qualify for a small home loan with monthly payments of less than what I was paying in rent. I knew that I could pay the bill each month, but proving it felt impossible.

Because I had the ability to go to my parents and ask them to co-sign for me, I was able to eventually buy a small house with relative ease. Proof of access to money, even though my parents have never paid anything toward my monthly mortgage bill, makes things exponentially easier. The less access to money you have, the more you pay in interest and loans as a “high-risk” borrower. Essentially, the price of homeownership goes up the less money you have. Many musicians I know have purchased homes without a co-signer by going through this process and paying far more than they should in taxes and health care bills. I believe there has to be a better system for allowing freelance artists to enter the housing market.

My friend and longtime bandmate Christian Sedelmyer has taken a big interest in this process. After purchasing his first home, he decided to get a real estate license so that he could help other musicians achieve their dreams of homeownership. I asked him a few questions about the process and his advice for freelancers hoping to take this step.

Can you tell me about your experience buying your first home? What did you learn about how the system works for freelance workers?

The first time I met with a lender, still in the exploratory stage of trying to figure out what was even possible, I was told that I made enough money, but that I needed to “stop writing everything off.” I remember feeling a mixture of both disappointment and motivation to right the ship, and I think it took me about a year and a half after that initial conversation to close on a home. But in retrospect, that information was pretty unhelpful as it’s only part of the story. The reality is that lenders look at write-offs in different categories, and having knowledge of where on your tax return to write off, for example, a new violin you purchased in the past year could actually make the difference between qualifying for a loan versus not being able to get a house at all. Ultimately, I learned that it’s totally doable to purchase a home as a freelancer, but it often requires more planning and knowledge about how the tax and lending worlds interact.

What drove you to want to get your real estate license?

Three days before I was scheduled to close on my dream home (we had been under contract for the 6 weeks prior, so I had naturally moved on to redecorating the interior in my head), I got a call from my agent saying that my loan was falling apart. I immediately called the lender and he explained to me that once the bank received the appraisal, there was something discovered that was a red flag for the particular type of loan I was getting and that there was no way around it. I’ll spare the details, but suffice to say, this is something that could and should have been caught much earlier in the process. I may not have been able to close on that home in the end, but at a minimum, I could have avoided 4-5 weeks of dreaming and planning my new life in that home, and instead moved on to something else. The thing that frustrated me the most was that it felt like it was completely out of my control — I had done everything correctly in terms of getting my finances in order: filing another year of taxes in a way that was viewed more favorably to lenders; saving for the down payment, closing, and rehab costs; building up my credit score — and in the end, the loan fell apart anyway. I had this feeling in my gut that so many of my musician and creative friends would appreciate a partner in the process who had dealt with disappointment in this way and would work hard on their behalf to make sure it wouldn’t happen to them. I also had a suspicion that there probably was another way to close on that home if we had started down a different road with a different lender earlier in the process, and I felt motivated to learn about the ins and outs of that world for self-employed individuals.

What is the biggest challenge facing musicians who want to purchase homes?

More often than not, the answer is getting a loan. In short, the lenders that offer the lowest interest rates (and hence more affordable mortgages) require a history of consistency tied to your tax returns that can sometimes take longer for musicians to build up, whereas if you are a salaried W-2 worker, you could have started your job very recently and still qualify for a loan. Tied to this challenge is the reality that the lending world can operate like a massive maze, with many doors to open and paths to choose. My advice would be to find a real estate agent and a lender (the agent should be able to help you with this) who are seasoned in and passionate about working with self-employed individuals. While some musicians are salaried with W-2 income, the vast majority are gig workers, and thus different sets of guidelines apply. This is especially true since the pandemic hit. That said, even if you get declined for a traditional mortgage, there are other creative loan products that could work for your situation. Having the mindset of “I’m going to make this happen, who is going to be on my team to help me get there?” rather than “Can I even do this?” is a great place to start. You CAN do this!

Do you think it’s important to own property versus renting? How did owning a house change your perspective on the possibilities of your own financial future?

I believe very much in the power of property ownership and its ability to transform lives. Particularly when spread over a long period of time, it can provide financial security (if you purchase with a fixed-rate mortgage, your mortgage only increases whenever property taxes or insurance increase, whereas your rent may increase every year depending on your landlord), an opportunity (though never guaranteed) for growing wealth through appreciation, tax benefits that don’t exist for renters, and most importantly, the benefits of feeling good about being creative with how you spend your money on the property, knowing you have at least some part to play in increasing its value over time, and holistic control over how developing that environment makes you feel and improves your daily life.

Buying a home that had a cool funk factor with room for improvements got me hooked on real estate in general, but eventually also got my mind moving in the direction of how to leverage that property to purchase others. I think the initial thought for me was that as a musician, there was no clear “retirement plan” or path to financial security laid out for me, and so I needed to create one. That has evolved over time to include things like “How can owning real estate help me fund making albums?” The reality was that once I got through the initial period of very normal anxiety about feeling that I didn’t know what I was doing, owning a home wasn’t all that different than renting. I also found that it forced me to get better at saving money, which is a great thing.

All of this said, real estate decisions are often deeply personal, and what’s best for one person may not be right for the next. Some prefer the idea of renting long term because they don’t want the responsibility of dealing with things that inevitably go wrong with the property. The answer will also vary based on the market you live in — in San Francisco or other high value markets, for example, it may make more sense for you to rent regardless of whether you can afford to buy there. Ultimately, I think there’s great benefit to defining what your goals are, and then determining how owning real estate may fit into that picture.

How could the system better allow for people who don’t have traditional W-2 employment arrangements to show their income?

So many ways. The importance of finding a lender that is well versed and enthusiastic about working with self-employed individuals can’t be overstated. But, since you asked about changing the system rather than simply working within it …

I believe that musicians, for example, are incredibly resourceful people. If someone is going on tour all summer and they’re worried about making rent (or just don’t want to waste money on a room they aren’t going to use), they’re going to find someone to sublet. They can prove, over time, that they can meet the responsibility of paying a fixed amount of money on time, every month. While every musician is familiar with this example, the traditional “fixed-rate, conventional mortgage world” — which typically provides the best interest rates — doesn’t have a mechanism for accounting for this scenario the way they do for looking at, say, job history. Getting credit in a more meaningful way for paying the amount of rent you’re responsible for and paying on time is one area where I think the system could improve considerably. (That said — you can ask your landlord to report your good standing to the credit bureaus — every little bit helps!)

Another is the “double penalty” for writing off meals while on the road, or per diems. Most musicians I know take advantage of this write-off, and a little known fact is that conventional lenders are literally required by law to take everything you expense in this category of your tax return and double it — effectively counting that write-off against you twice, meaning there is less qualifying income the lender can use when approving your loan. I often differentiate between “good,” “neutral,” and “bad” write-offs — and while I classify the per diem write-off as a “bad” one if you’re trying to purchase a home in the near future, a much better solution would be Congress passing an exception to this lending guideline that distinguishes between self-employed musicians and artists who are just feeding themselves versus a businessperson taking people out to eat and drink on the company’s dime (the scenario that created the regulation).

How does family wealth and access to privilege affect people’s ability to purchase homes?

Generational wealth can play a large role in someone’s ability to get started in real estate. For example, whether through down payment assistance or providing access to qualifying income through co-signing, there’s no question that it is a privilege to have access to these things, and it’s important to recognize that many people do not.

You can find Christian Sedelmyer at www.christiansedelmyer.com.